Content

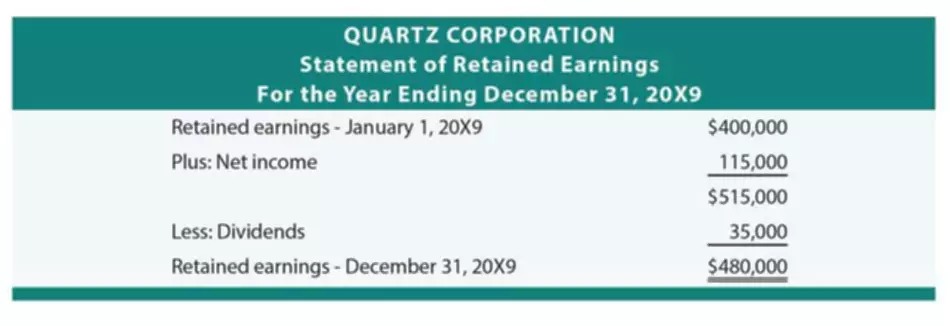

This is the same figure found on the statement of change in equity and balance sheet prepared in the previous section. Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts. Next up, we’ll transfer the income summary account balance to permanent accounts—the retained earnings account in this case.

Retained Earnings is the only account that appears in the closing entries that does not close. You should recall from your previous material that retained earnings are the earnings retained by the company over time—not cash flow but earnings. Now that we have closed the temporary accounts, let’s review what the post-closing ledger (T-accounts) looks like for Printing Plus.

Concluding Remarks: The Importance of Understanding How to Complete the Accounting Cycle

Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. Income summary is a holding account used to aggregate all income accounts except for dividend expenses. Income summary is not reported on any financial statements https://www.bookstime.com/ because it is only used during the closing process, and at the end of the closing process the account balance is zero. Temporary account balances can either be shifted directly to the retained earnings account or to an intermediate account known as the income summary account beforehand.

A general ledger is a record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. The remaining balance in Retained Earnings is $4,565 the following Figure 5.6. This is the same figure found on the statement of retained earnings. If the balance in Income Summary before closing is a credit balance, you will debit Income Summary and credit Retained Earnings in the closing entry. Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns. In this segment, we complete the final steps of the accounting cycle, the closing process.

Financial and Managerial Accounting

The income summary is used to transfer the balances of temporary accounts to retained earnings, which is a permanent account on the balance sheet. You are a newly hired accountant for Boss Consultants Inc (“Boss”), a consulting firm located in Chicago. Boss just started its business this year as a simple operation that offers a premium, boutique service. It is now the end of the first quarter, and the company must prepare financial statements for an upcoming bank loan application. You are in charge of closing the books, and you are confident since you are a master of closing entries.

- The credit to income summary should equal the total revenue from the income statement.

- Usually, Liability accounts, Revenue accounts, Equity Accounts, Contra-Expense & Contra-Asset accounts tend to have the credit balance.

- In essence, we are updating the capital balance and resetting all temporary account balances.

- So when you close out a temporary account, you add from the totals shown in the permanent accounts.

- Afterwards, withdrawal or dividend accounts are also closed to the capital account.

- The word “post” in this instance means “after.” You are preparing a trial balance after the closing entries are complete.

The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account.

Overview: What are closing entries?

Usually, Liability accounts, Revenue accounts, Equity Accounts, Contra-Expense & Contra-Asset accounts tend to have the credit balance. Real AccountsReal accounts do not close their balances at the end of the financial year but retain and carry forward their closing balance from one accounting year to another. In other words, the closing balance of these accounts in one accounting year becomes the opening balance of the succeeding accounting year. Debit BalancesIn a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction. In a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance.

These accounts will not be set back to zero at the beginning of the next period; they will keep their balances. The next day, post closing trial balance January 1, 2019, you get ready for work, but before you go to the office, you decide to review your financials for 2019.

This is the adjusted trial balance that will be used to make your closing entries. While these accounts remain on the books, their balance is reset to zero each month, which is done using closing entries. All revenue, income or dividends that a company earns are transferred into retained earnings.

The post-closing trial balance is also used to double-check that the only accounts with balances after the closing entries are permanent accounts. If there are any temporary accounts on this trial balance, you would know that there was an error in the closing process. A company must close the income summary and transfer its balance to the account of retained earnings by posting the income summary balance to retained earnings. Depending on whether it is a credit or debit balance in the income summary account, the transfer of income summary can be an increase or decrease to retained earnings.

The longer process requires temporary accounts to be closed in an intermediate income summary account first and then that account is zeroed out to the retained earnings. The result in both cases is the same and depends on the bookkeeper’s preference or company’s policy on it. A temporary account records balances for a single accounting period, whereas a permanent account stores balances over multiple periods.

No responses yet